As the adoption of solar energy continues to grow, understanding the value of used solar photovoltaic (PV) systems becomes increasingly important, especially for businesses with large property portfolios, insurers, and financiers. Whether you are buying, selling, or maintaining a property with an existing solar system, accurately assessing the system’s value is essential for making informed decisions.

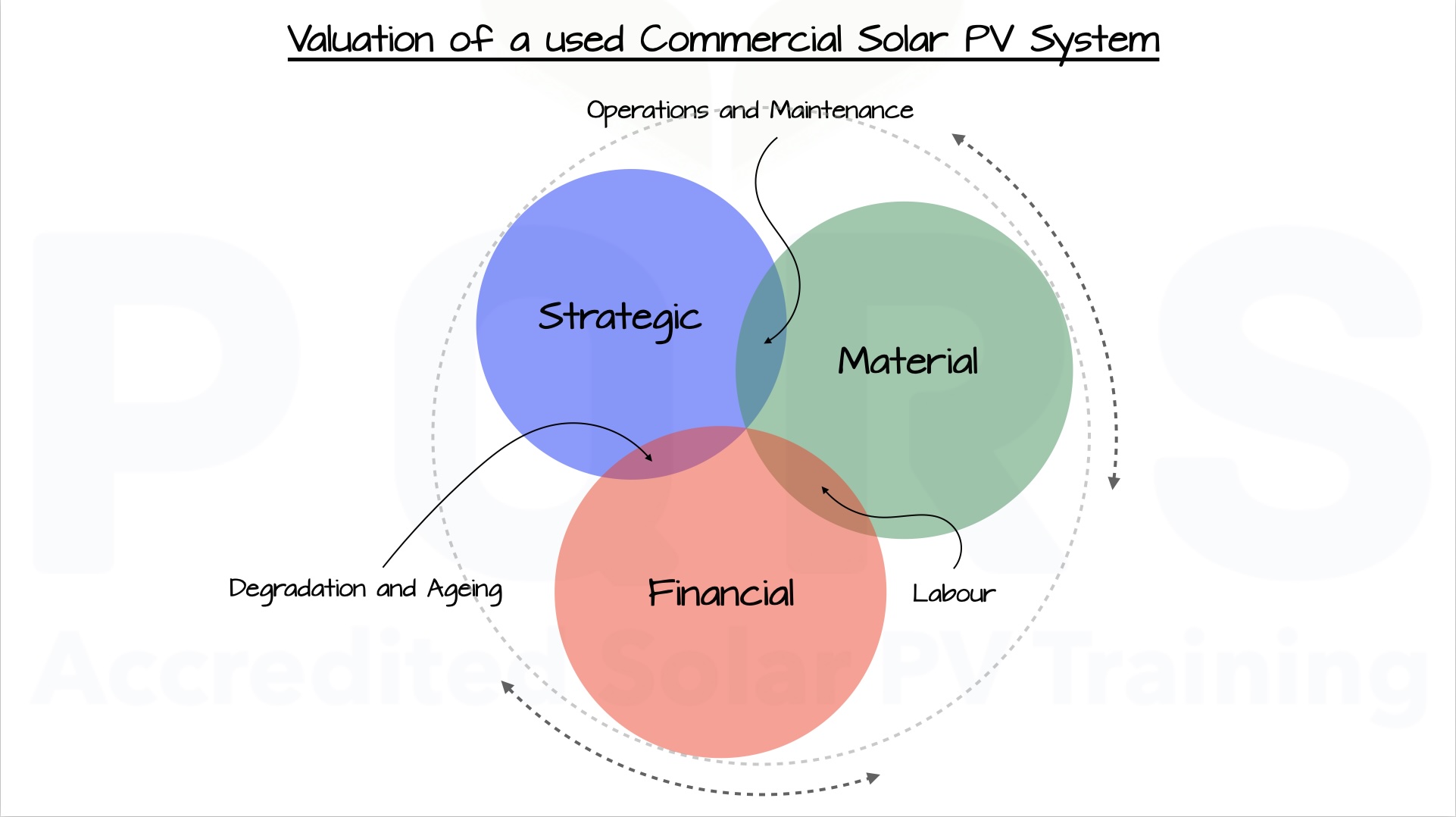

The valuation of a used solar PV system is multifaceted, involving three primary components: Financial, Strategic & Emotional, and Material. Additionally, there are key subcomponents—Labour, Operations & Maintenance, and Degradation & Ageing—that significantly impact the overall value. The attached diagram illustrates how these components interact to form a comprehensive understanding of the system’s value.

The Financial component represents the tangible and measurable value of the system. This includes the material cost of the system, and the labour associated with its installation.

2. Strategic & Emotional Component

The Strategic & Emotional component encompasses the intangible aspects that influence the value of the system beyond its material and financial worth. These aspects vary greatly for commercial systems and residential installations.

- Commercial Systems – Strategic Value: For businesses, a solar PV system may serve strategic goals such as enhancing corporate sustainability, meeting renewable energy targets, and appealing to eco-conscious consumers or investors. Strategic value is tied to the company’s long-term goals, like improving energy independence or aligning with environmental standards, which can positively influence brand image and market positioning.

- Residential Systems – Emotional Value: For homeowners, the decision to install solar energy is often driven by emotional factors such as energy security, independence from unreliable grids, or contributing to environmental sustainability. While emotional value is less relevant in commercial settings, it can significantly impact residential solar installations.

The Material component refers to the physical assets of the solar PV system—the hardware and infrastructure that make up the installation. This component focuses on the tangible items that determine the system’s current and future performance.

The physical hardware of the system, such as the solar panels, inverters, mounting structures, and batteries, forms the foundation of the financial value. Over time, these components experience degradation, which impacts the system’s efficiency and its ability to generate power.

Subcomponents: Key Considerations for Accurate Valuation

The subcomponents—Labour, Operations & Maintenance, and Degradation & Ageing—add layers of complexity to the valuation process. These elements need to be evaluated alongside the primary components to determine the overall worth of the system.

- Labour: The labour cost of an installation significantly influences the total system cost. The amount of labour required for installation can vary depending on system size and complexity, which in turn impacts the system’s value and returns over time.

- Operations & Maintenance: Ongoing maintenance is crucial to the longevity and efficiency of solar systems. Systems that have been well-maintained will generate energy at optimal levels, preserving their value. Neglecting regular maintenance (e.g., panel cleaning, component inspection) can lead to reduced energy output and lower overall system value.

A well-maintained system can operate optimally for years, generating consistent energy output and maximizing financial returns. The O&M component ensures that the system operates as intended, minimizing downtime and costly repairs. Neglecting maintenance can lead to decreased efficiency and increased repair costs.

- Degradation & Ageing: As solar systems age, their performance naturally declines. Understanding the degradation rate of key components like solar panels and batteries is essential for determining the remaining useful life of the system and estimating its future performance. Typically, solar panels degrade at a rate of 0.5% to 0.7% annually. Over time, the system’s ability to generate power decreases, which affects its financial value. It’s essential to consider the warranty conditions for each component and the expected remaining useful life of the panels and batteries. Batteries also degrade based on throughput and the value could be confirmed by comparing warranties with remaining lifespan or throughput.

Conclusion: A Holistic Approach to Solar PV System Valuation

Accurately valuing a used commercial solar PV system requires a comprehensive understanding of its financial, strategic, and material components. Each of these elements, alongside subcomponents such as labour, operations & maintenance, and degradation & ageing, plays a crucial role in determining the system’s true worth.

For businesses, insurers, and financiers, considering all aspects of a solar PV system’s value—from its tangible costs to its strategic and emotional benefits—ensures that you make informed decisions about buying, selling, or maintaining solar assets. By regularly monitoring and maintaining these systems, stakeholders can maximize their value and ensure optimal performance over time.

By integrating these factors into the valuation process, businesses can derive a fair and realistic assessment of the system’s current and future value, thereby safeguarding their investments in properties that include renewable energy components.

Contact us for a valuation on your solar PV system